Non-inhabitant Indians face part of the issues with regards to getting to their acquired moveable resources in India. Rigid arrangements of banks in regards to delivering the assets of perished people leave lawful beneficiaries in chaos as they are not completely familiar with the laws and methodology to get to these resources. A succession certificate is presently compulsory for getting to versatile resources whether they possibly subsidize secured up ledgers or ventures held as equities, Government securities, shared assets, or any such monetary instruments or these perhaps supports held in mail depots in India.

What is Succession Certificate In India?

Succession Certificate is a legal document that is given by the court to affirming moveable resources by the replacements of the deceased individual. It builds up the authenticity of the beneficiaries and gives them the power to get to the resources. It is given by the proper common courts in India under the important laws of legacy on an application recorded by the recipients in a court of relevant purview for issuance of such a progression endorsement.

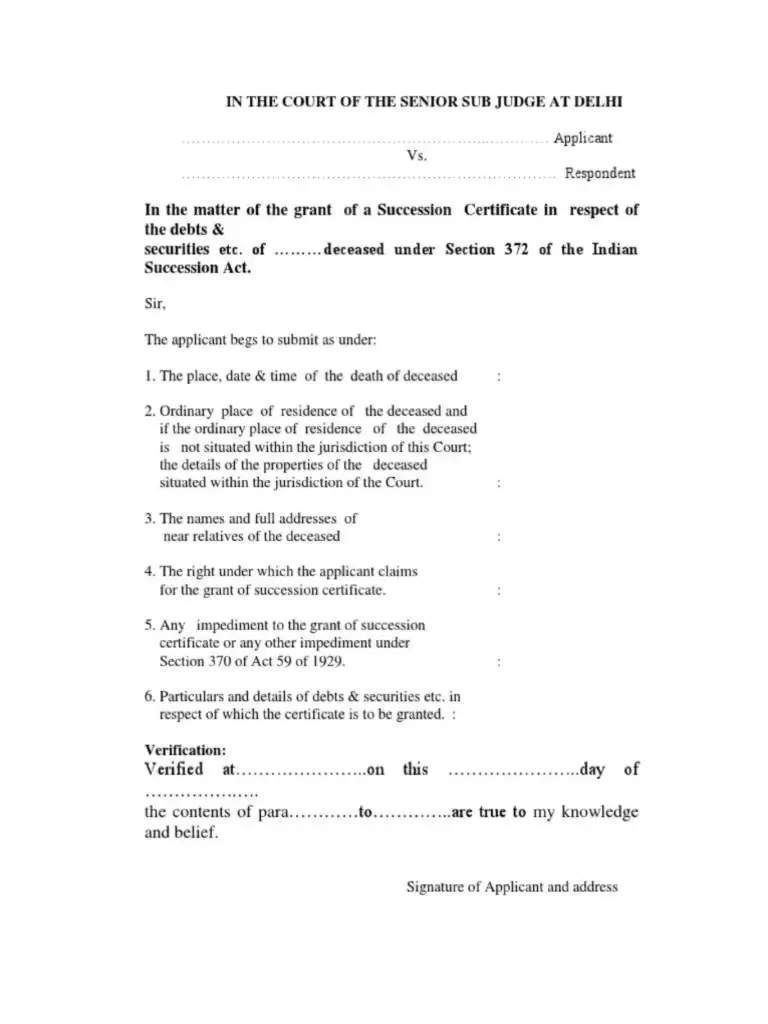

Succession Certificate Format In India (PDF):

Succession Certificate In India Format (JPEG/JPG):

Acquiring a Succession Certificate in India :

The recipient should record a request to secure an endorsement in an official courtroom.

The testament might be given by a District judge under whose purview the versatile resources being referred to are found, or by an adjudicator under whose power the perished lived.

The request should indicate the name of the recipient, his/her relationship with perished, names of any remaining Class 1 Legal beneficiaries.

The passing authentication of the expired individual whose resources are being requested by the lawful beneficiaries should be appended to the request.

The court will then, at that point tell the gatherings concerned and give a time period inside which anybody may protest. On the off chance that no complaint is raised, the court gives a progression testament to the recipient.

In the case of numerous recipients, a joint endorsement is given.

Law Credo

Law Credo